The Net Promoter Score (NPS) is a common metric used by management to gauge customer relationships. It consists of a single question that asks about likelihood to recommend. But there is wide disagreement about whether the Net Promoter Score is useful so let’s sort through the issues.

The Good

Awareness: We’ve got to start with gratitude. The development and introduction of the NPS shed a lot of light on the value of measuring customer experience. It brought attention to customer service issues not just at the customer management level, but also at the executive leadership level. It’s impressive that a score representing customer experience has managed to get a seat at the table when so many other people and departments are clamoring and failing to get there. Kudos to the NPS inventors for making this happen!

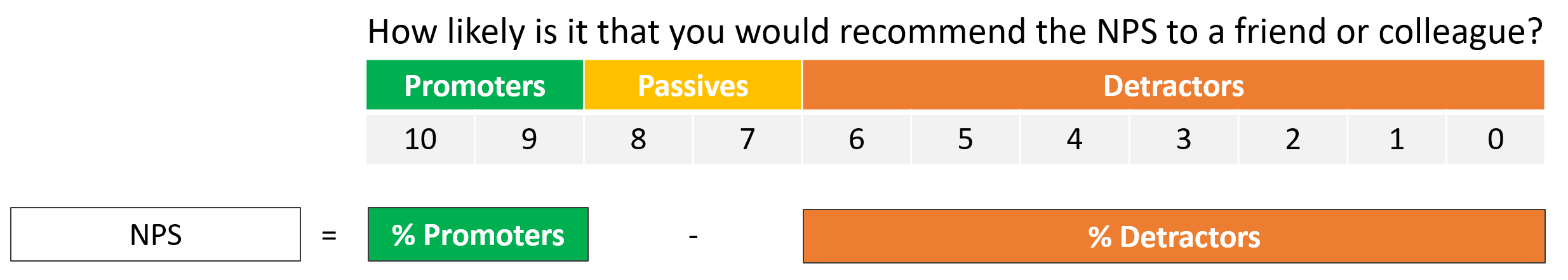

Simple to calculate: The score is accessible to a wide range of people due to the simplicity of its calculation. You don’t need highly skilled analysts to run datasets through complex algorithms. Subtract two key numbers and you’re done. And, with the single resulting number, you can determine whether your customer experiences are being exceeded, met, or failing miserably.

Highly relevant: Whether your business is B2C or B2B, and whether you’re seeking an internal or external metric, the score is highly relevant to a huge range of applications – certainly not every application, but many. As long as you’re dealing with a product or service that one person might legitimately recommend to another person, there is little need to hunt around to find a metric that has been and can be used in your unique situation.

Benchmarking and tracking: The fact that the score is widely understood and used means that it is an excellent source of benchmarked data. Scores can be measured across product SKUs, categories, industries, or even broadly across business. In every case, it’s quick and simple to see how your product or service compares to a target group of interest.

Easy to understand: The score is simple. The question itself is easy for research participants to understand and answer. It uses no jargon, and requires no unusual knowledge to understand it. Although the metric uses a 0 to 10 scale, people are familiar and comfortable with 1 to 10 scales. They have an intuitive understanding of what ‘3 out of 10’ or ‘8 out of 10’ means.

Similarly, the question is easy for research users to understand. It doesn’t matter whether you’ve used the metric for decades or just graduated from college, the metric is understandable and relatable to everyone. Even without completing a specialized workshop.

As such, new companies or companies just beginning their customer experience measurement journey can start measuring NPS with minimal investment of time and money.

Take a quick look on Twitter to see just how much people love the NPS!

The Bad

Scores are variable: A good score for one type of product, category, or business is not necessarily a good score for another. People love to hate banks, airlines, and cell phone companies and so they will naturally generate low scores – even the best in class companies. And when it comes to categories we love, even the worst in class could generate good scores. Hence, a ‘good’ score isn’t always a good score.

Actions speak louder than words: The NPS question asks people to hypothesize about potential experiences. As researchers, we often say that the best predictor of future behaviour is past behaviour. We never say that the best predictor of future behaviour is current opinion. And yet we ask people to share their opinions and we base our actions on those hypothetical judgements. Hypotheticals are not reality.

Multiple metrics: Use of the score becomes questionable when it is not combined with other metrics or data points such as CSAT scores or in-depth interviews with both extremely satisfied and dissatisfied customers. A single number can never reveal the wide range of intricate issues a company must deal with from stores, suppliers, vendors, locations, technologies and more. Companies that rely on a single metric or KPI can never truly understand the entire customer experience incorporating thoughts, feelings, and emotions that result along the customer decision journey.

Satisfaction <> Recommendation: People regularly recommend products they dislike, have never used, and have never bought. Part of the human experience is listening to word of mouth and sharing those learnings with others. Thus, as people strive to be helpful and share the knowledge they’ve acquired from others, the accuracy of NPS scores will be questionable.

Data without the why: As much as we’d like to know the final score, it’s worthless if we don’t know how we got to that score. Do people recommend something because of the product or the service? Because of the price or colour? Because of the employee or the location? If companies don’t know what is driving a positive or negative score, they won’t know what to improve or showcase. NPS users need to dive into customer comments and verbatims, conduct deep dive qualitative research, and truly understand what is leading to those results.

Further, knowing what happened in the past is important, but it’s vastly more important to look forward and identify problems as they happen or, even better, before they happen. Technology is helping us get there.

Data without action: With a number and a why in hand, companies that don’t act on those results, whether good or bad, might as well put their money back in their pocket and not proceed with the data collection process at all. Companies that get distracted by good numbers can easily be overtaken by competitors that act on their results and work consistently to improve their experience.

The Ugly!

Score chasing: Perhaps the worst thing about the NPS is score chasing. Of course, that’s not the fault of the NPS. That’s simply human nature. When you find yourself focused single handedly on getting a 75 or an 80 or 90 to the point that you’ve forgotten about the actual customer experience, the reason for calculating the score is lost. Score chasing becomes an even bigger problem when metrics such as the NPS are tied to salaries and bonuses. Make sure this is not a problem for you.

It’s not carved in stone: The score is a hypothetical construct made up by people to help them achieve a goal. It’s not final, it’s not unchangeable, it’s not perfection. But we sometimes get so involved and become so reliant on it, that we forget… it’s just an idea. A changeable idea that can and ought to evolve as we become better translators of the human customer experience. As you use a variety of customer experience and satisfaction metrics, figure out what does and doesn’t work for you. Revise things along the way. Adjust things to suit your needs. Don’t rely on a single number because the books say you must. Rely on a set of numbers that serve your purposes and help you grow and succeed.

People are not numbers: It’s very easy to rely on a number and forget that there are hundreds, thousands, or millions of human beings contributing to it. Every score represents the thoughts, feelings, and emotions of real people whose lives are impacted during every customer experience. The day you forget that is the day your score plummets and your business is lost.

Take a quick look on Twitter to discover more reasons why people have trouble with NPS scores.

What’s next?

The good, the bad, and the ugly are now fully laid out. I’m sure you’ve noticed that the disputes are not inherent in the NPS. The metric itself is a lovely, little, concise metric. Rather, the disputes are related to the use of the metric – how people fail to use it appropriately as part of a broader customer experience system, or in combination with other relevant tools and actions. And those problems are easily solved. They may not actually be solved, but they are easily solved. Let’s put a bit of human nature into that and choose to solve those problems the next time we decide to use the NPS.