According to Harvard Business School, there are over 30,000 new products introduced every year, and 95 percent fail. Why do products fail so frequently? How do you make sure your product stands out?

For decades, researchers have studied consumer behaviours through different methods, such as online and telephone surveys, in-person interviews, in-home usage testing (IHUT), eye-tracking and facial coding, and sensory testing. In order to avoid expensive failures, companies need to gain consumer insights before launching their products. Research access panels are often the perfect way to gather opinions from hundreds or thousands of people. But the common concern among researchers and clients is, which panel would suit the needs of the study.

Often sample companies highlight the size of their panels to show scale. But do you think the size of the panel matter? Do researchers avoid using small panels?

Imagine two hypothetical panels; Panel One offers 1 million panelists, and Panel Two has 200,000 panelists. Both panels launched the same questionnaires to their panelists; Panel One got 50,000 completes (response rate 5%), and Panel Two got 50,000 completes (response rate 25%). Even though Panel One is 5 times larger than Panel Two, the effective size of both panels is identical. So, what is the point of emphasizing the size when the response rate is the more critical metric?

Panel size is not a great indicator; however, traffic, diversity, and data quality are the other metrics you should consider when selecting a panel. For example, if you are launching an ad on Instagram to recruit people to take a survey, do you care that Instagram has roughly one billion active users? Or do you care about those who are the perfect matches to your criteria?

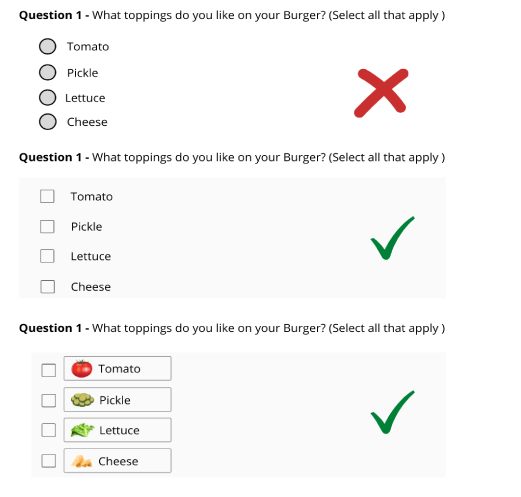

Panel rules are very crucial when conducting research. When thinking about which panel you should consider working with, keep in mind what defines an active panelist? Does the sample group represent the target population? How are termination rules determined?

PANEL SIZE MATTERS, but the best indicator is whether you will receive the number of completed surveys you require.

Transparency is simple and is the key to successful research; as clients, you have a right to know if your vendor targets the right audience for your research. If you are unsure how to address transparency and compare services of different suppliers, review ESOMAR’s 28 Questions to Help Buyers of Online Samples is a great place to start. As corporate members of ESOMAR, we’d love to share our ESOMAR 28 Questions answers with you too. Please get in touch with us and ask for them!

You might like to read these: